Finally, bringing some relief to the Centre the core infrastructure industries have rebounded in the month of April. The surge in infrastructure output from 2.5 per cent in March to 4.2 per cent in April indicates an uptick in the economy.

Core infrastructure industries are roaring again. Sectors such as electricity, steel, coal, cement and fertilisers are robust. While growth in electricity, steel and cement is a harbinger of an improvement in the construction industry, the recent lifting of the mining ban in Goa and a temporary respite in Odisha and Karnataka is likely to revive manufacturing activities. Infrastructure is considered to be the most significant sector of the country's economy as it contributes to about 38 per cent of share to Index of Industrial Production (IIP). The fluctuations in core industries of the infra sector have direct impact on the country's industrial output.

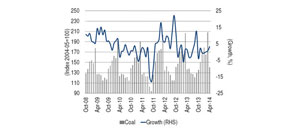

Let's take a look at the performance of the core infrastructure sector. The core infrastructure industries, with a weightage of 37.9 per cent in the IIP, grew 4.2 per cent in April 2014 as against 3.7 per cent a year ago. In the same month, electricity (11.2 per cent) and fertilisers (11.1 per cent) posted the strongest growth followed by cement (6.7 per cent) steel (3.1 per cent) and coal (3.3 per cent). According to experts, electricity, steel and cement (a combined weightage of 19 per cent) are likely to continue to grow robustly. That said, Sujan Hajra, Sr. Analyst, Anand Rathi comments, “While coal has already gained momentum, the improvement in operational and procedural aspects would further help the sector.”

Assessment

According to Sujan Hajra and Moumita Samanta, Sr. Analysts, Anand Rathi, the eight core infrastructure industries continue to do much better than industrial production overall. Growth was broad-based, with six of the eight sectors (excluding refineries and steel) doing better y-o-y than last month. Electricity growth was back to double digits. Fertilisers surprised on the higher side by posting a strong figure. But importantly, growth in coal and cement has picked up momentum and steel is buoyant.

The IIP is also likely to grow at a higher pace due to better performance of the core sector, which comprises 38 per cent of the IIP. The IIP has shown no signs of recovery for the second month in a row, contracting 0.5 per cent in March due to declining output in manufacturing, especially capital goods.

Leave a Reply

You must be logged in to post a comment.