With leasing volumes consistently exceeding 50 million square feet annually for three consecutive years, India’s logistics sector is now poised to cross 60 million square feet by December, setting a new benchmark in its ascent as a global supply chain hub.

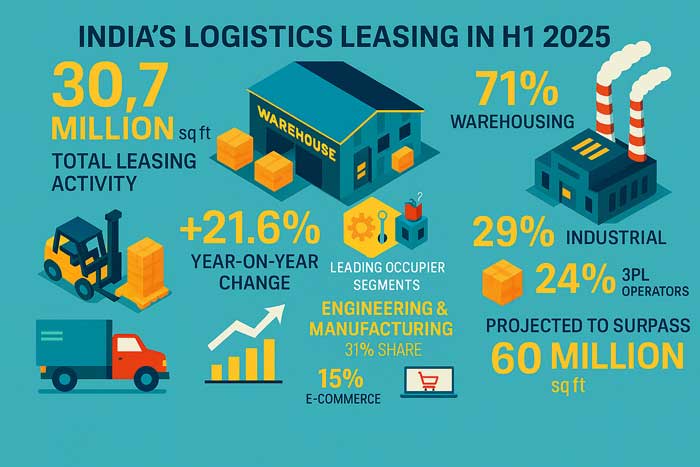

India’s logistics and industrial real estate sector recorded robust double-digit growth in the first half of 2025, with total leasing activity reaching 30.7 million square feet (MSF), a 21.6 per cent year-on-year increase, according to global real estate advisory firm Cushman & Wakefield’s latest Logistics & Industrials Marketbeat Report.

The performance also marked a 12.1 per cent rise over H2 2024, underscoring the sector’s structural resilience and sustained demand across warehousing and industrial segments.

With leasing volumes consistently surpassing 50 MSF annually for three consecutive years, the sector is now poised to cross 60 MSF by December, setting a new benchmark for India’s role in global supply chains.

Warehousing continued to dominate, accounting for 21.9 MSF or 71.3 per cent of total leasing, while industrial space contributed 8.8 MSF, representing 28.7 per cent. Engineering and manufacturing firms led the charge with 9.7 MSF—nearly a third of total absorption—reflecting a 37 per cent annual growth. This surge aligns with India’s push for self-reliance in manufacturing, supported by infrastructure upgrades and policy tailwinds.

Third-party logistics (3PL) operators leased 7.4 MSF, maintaining a 24 per cent share and signalling market maturity. E-commerce, meanwhile, posted the sharpest annual rise, growing 158 per cent to reach 4.6 MSF, driven by festive season stocking and last-mile network expansion.

Shift Towards Structural Strength

Commenting on the sector’s trajectory, Abhishek Bhutani, Managing Director, Logistics & Industrial Services India, Cushman & Wakefield, said the first-half performance reflects a shift from cyclical swings to structural strength. “Occupiers are no longer only chasing capacity but also efficiency, location, and long-term value. What stands out is the sharper role of manufacturing and the resurgence of e-commerce, which together are reshaping supply chain strategies,” he said.

Bhutani added that the stabilisation of 3PL activity indicates a more mature logistics backbone, with rising occupier interest in strategic hubs and a robust Grade-A supply pipeline positioning the sector to cross 60 MSF in 2025.

Among cities, Mumbai led with 7.0 MSF—23 per cent of total leasing—registering a 131.3 per cent annual growth. Delhi NCR followed with 5.1 MSF (17 per cent), while Pune contributed 4.5 MSF (15 per cent). Chennai, Bengaluru, Hyderabad, and Kolkata also posted steady activity, with Ahmedabad emerging as the fastest-growing market, recording 1.7 MSF and a 192.2 per cent year-on-year surge.

Looking ahead, the sector is expected to maintain its upward trajectory, supported by a Grade-A warehousing supply pipeline of approximately 25 MSF over the next two to three years. Growth will be driven by manufacturing expansion, deeper e-commerce penetration into Tier-II and Tier-III cities, and continued adoption of technology in supply chain management.