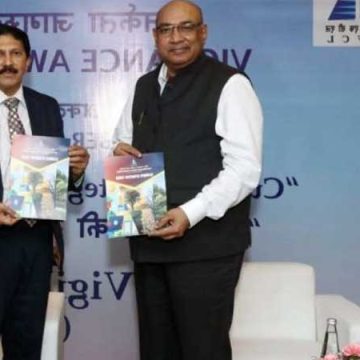

In a significant step towards promoting sustainable infrastructure, the government-owned financial institution IIFCL unveiled its Climate Strategy 2030 document during the Vigilance Meet held on October 30 in New Delhi. The document was released in the presence of Dr. PR Jaishankar, Managing Director, IIFCL, with AS Rajeev, Vigilance Commissioner, Central Vigilance Commission, as the Chief...

FlashNews:

ISA and IIT Delhi Partner to Build Global Solar Skills

Solar Service Searches Surge 43% Nationwide, Justdial Data Shows

Centre Clears ₹7.97 Billion Green Hydrogen Jetty at Paradip Port

ONGC Hosts 7th Para Games, Championing Inclusion in India Inc.

India’s Space Sector Secures Cyber Shield with CERT‑In, SIA‑India Guidelines

GAIL Breaks Ground on Sohna R&D Centre to Drive Clean Energy Innovation

Veolia Secures 2 Landmark Mumbai Water Projects to Boost Urban Sustainability

Emirates SkyCargo Expands India Freighter Network to Meet Rising Trade Demand

Colliers Maps 30 Industrial & Warehousing Growth Hubs Across India

PAIMANA Portal Tracks ₹39 Trillion Infrastructure Projects in January 2026

Tata Power-Warwick Alliance to Accelerate Energy Systems Innovation

India’s Space Kidz Launches World’s First Space Curriculum for Schools

Road Awards Slowdown to Hit Execution, Intensify Bidding: ICRA

Clean Energy Transition: India’s Global Leadership

Dual Airports to Handle 40 Million Passengers in 2026, Timely Ramp‑Up Crucial: Crisil Ratings

Kazipet Coach Factory Ready for Commissioning as RVNL Completes Core Works

Suzlon Reshapes Leadership: J P Chalasani Elevated, Ajay Kapur Named Group CEO

Noida International Airport Partners Mann Fleet for Seamless Ground Mobility

SDHI to Complete Five Offshore Support Vessels for San Maritime at Pipavav Shipyard

Tag: financial institution

Rs.2,000 crore for Puducherry infra

Puducherry Chief Minister V Narayanasamy has said that The Agence Francaise Developpement (AFD), a public financial institution in France would extend assistance of over Rs.2,000 crore for developing infrastructure in the Union Territory

IFCI seeks development financial institution status

IFCI Ltd is seeking to become a development financial institution as it would lower its cost of funds. The company will place a proposal with the government seeking the tag of a 'developmental financial institution' which could raise its credit rating and make its securities attractive to investors.

Financial entities’ share in bond issue declines

Data collected by Prime Database shows that the share of financial sector entities in the total amount raised through private placement of bonds during April-September 2012 declined to 73.1 per cent from 90.3 per cent in 2011-12 and 78.3 per cent in 2010-11. The financial entities include primarily banks and non-banking finance companies (NBFCs). According to som