Sanjeev Kaushik, a 1992 batch IAS officer of the Kerala cadre, has taken over as the Executive Director of State-owned India Infrastructure Finance Company Ltd (IIFCL).

FlashNews:

India’s SDHI Lands Landmark Oman Defence Ship Deal

Air India Unveils First Line‑Fit Boeing 787‑9, Signals Bold Global Transformation in 2026

Vizhinjam Expansion Strengthens India’s Maritime Competitiveness: Sonowal

Tata Power Odisha Discoms Secure Top National Rankings for Third Consecutive Year

SDHI Secures $227 Million Chemical Tanker Deal, Revives India’s Commercial Shipbuilding

India’s Energy Transition Sets Global Pace: Pralhad Joshi at Davos

IWDC Clears ₹15 Billion Projects to Boost Green Mobility, Cargo and River Tourism

World Bank Approves $815 Million Financing for Tata Power-DGPC Dorjilung Hydropower Project in Bhutan

Indian Railways Deploys Humanoid Robot ASC ARJUN at Visakhapatnam for Smart Station Security

India’s Power Grid Crosses 500,000 Circuit Km, Marks 71.6% Growth Since 2014

India Inc Optimistic on Growth, Flags Infrastructure, Defence and Export Priorities: FICCI Survey

NHAI, Konkan Railway Ink MoU to Boost Integrated Road‑Rail Infrastructure Development

DGCA Digitises Pilot Licensing with Electronic ATPL Services to Strengthen Aviation Ecosystem

Power Minister Calls for Financially Strong Discoms to Drive India’s Energy Future

BLR Airport Launches Gate Z, India’s First Social Lounge Redefining the Airport Experience

MoPNG Highlights Financing Strength, Regulatory Reforms Ahead of New Upstream Bid Rounds

ABB India Modernises BPCL’s Vadinar‑Bina Pipeline for Uninterrupted Operations

Vaishnaw Projects 6-8% Growth, Highlights Reform Momentum at Davos

Aerem Solutions Secures $15 Million to Drive Distributed Solar Adoption Across India

A call on telecom

India´s telecommunication network is the third largest in the world and the second largest among the emerging economies of Asia. It has witnessed phenomenal growth over the last decade as substantiated by the following facts and figures

Budget 2015: The chinks and the missing links

Budget 2015 echoes the need to foster the infrastructure ecosystem and outlines the policies and reforms which are expected to revive the growth of infrastructure which has remained tepid.

India has the capacity to fund projects more than Rs.1 lakh crore annually

In a candid interview, finance veteran Arun Purwar, Chairman of IndiaVenture Advisors Pvt Ltd & PHL Finance, suggests that since the bond market is deep enough to take care of funding requirements of infrastructure projects, the government must encourage infrastructure fund raising through the bonds.

We want to be part of Indias industrial growth

In an exclusive interview, Luis-Miguel GutiTrrez, Office Director, KfW IPEX-Bank GmbH shares details on the bank´s growing interests in funding Indian infrastructure. Recently, Germany has shown interest in investing in the $90 billion Delhi-Mumbai Industrial Corridor (DMIC).

FDI Ultimate Game Changer

Though investment in infrastructure is expected to touch $1,025 billion in the Twelfth Five-Year Plan (2012-17), many hurdles are choking investment inflows despite the government´s overdrive to attract funds. The government´s recent decision to open up the railway sector to Foreign Direct Investment (FDI)

Matching the mismatch

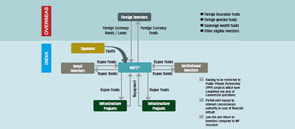

IDFs play a vital role as investment vehicles that can be sponsored by NBFCs and commercial banks in India. Shrikanth S writes on how IDFs are correcting the asset-liability mismatch, and also help advance loans for fresh infrastructure projects. The urgent need to improve infrastructure prompted the Indian Planning Commission to estimate infrastructure spending in the 12th Five Year Plan (2012-17).

There will be a second round of restructuring for infra projects

The alarming increase in bad loans from infrastructure was partly responsible for restructuring of bank loanks. B Sriram, Managing Director, State Bank of Bikaner & Jaipur, which saw a fall in its profits in the quarter ending December,

Infra sector will regain momentum only in medium-to-long term

It seems controllable and uncontrollable factors have converged on the infrastructure sector, causing lenders and investors to step back in their plans. Ranjit Manjarekar, COO Infrastructure Finance, Tata Capital, tells Infrastructure Today that lack of visibility of returns, stemming from uncertainties, is a big dampener, but tells us how his firm is manoeuvring around the roadblocks to identify the right segments to go after.

It is good to be under RBI regulations as an NBFC

India Infrastructure Finance Company Ltd (IIFCL) may not see a paradigm shift because it was recently bestowed the NBFC status. Yet the company now hopes that regulation will help define its processes and growth better, Harsh Kr Bhanwala, Executive Director, IIFCL, tells Shashidhar an undaiah.