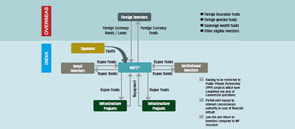

IDFs play a vital role as investment vehicles that can be sponsored by NBFCs and commercial banks in India. Shrikanth S writes on how IDFs are correcting the asset-liability mismatch, and also help advance loans for fresh infrastructure projects. The urgent need to improve infrastructure prompted the Indian Planning Commission to estimate infrastructure spending in the 12th Five Year Plan (2012-17).

FlashNews:

Air India, Lufthansa Group Ink Landmark MoU to Boost India‑Europe Connectivity

GMRIT Achieves Deemed University Status, Strengthens Academic Expansion

India Adds Record 52.5 GW Power Capacity in FY2025‑26, Driven by Renewables

REC to Drive AI‑Powered Energy Innovation at India AI Impact Summit 2026

Inox Clean Energy, RJ Corp Enter Africa’s IPP Market, Target 2.5 GW by FY2029

Best Pills for Erection: Myths, Facts, and Smart Choices

Best Pills for Erection: Audience‑Specific Guidance with Safety Disclaimers

DIAL Launches Family@DEL: First Family‑Centric Travel Initiative at an Indian Airport

India’s SDHI Lands Landmark Oman Defence Ship Deal

Air India Unveils First Line‑Fit Boeing 787‑9, Signals Bold Global Transformation in 2026

Vizhinjam Expansion Strengthens India’s Maritime Competitiveness: Sonowal

Tata Power Odisha Discoms Secure Top National Rankings for Third Consecutive Year

SDHI Secures $227 Million Chemical Tanker Deal, Revives India’s Commercial Shipbuilding

India’s Energy Transition Sets Global Pace: Pralhad Joshi at Davos

IWDC Clears ₹15 Billion Projects to Boost Green Mobility, Cargo and River Tourism

World Bank Approves $815 Million Financing for Tata Power-DGPC Dorjilung Hydropower Project in Bhutan

Indian Railways Deploys Humanoid Robot ASC ARJUN at Visakhapatnam for Smart Station Security

India’s Power Grid Crosses 500,000 Circuit Km, Marks 71.6% Growth Since 2014

India Inc Optimistic on Growth, Flags Infrastructure, Defence and Export Priorities: FICCI Survey

Tag: Infradebt

Infradebt refinances road project

India Infradebt (Infradebt), which is the countryÂ’s first Infrastructure debt funds (IDFs) in the NBFC format, completed its first transaction by refinancing a road project of Zirakpur-Parwanoo section of NH-22. The stretch is built by Himalayan Expressway, which is part of Jaiprakash Group. The debt fund is sponsored by ICICI Bank along with Bank of Baroda, Citigroup and LIC

India Infradebt to issue Rs 5 bn worth debentures

In order to finance infrastructure projects, India Infradebt is in the process of issuing Rs 500 crore worth of debenture. The debenture was assigned AAA/Stable rating by CRISIL. ICICI Bank, Bank of Baroda, Life Insurance Corporation of India and Citicorp Finance (India) jointly promoted Infradebt as an infrastructure debt fund (IDF) in the non-banking financial company