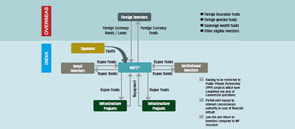

IDFs play a vital role as investment vehicles that can be sponsored by NBFCs and commercial banks in India. Shrikanth S writes on how IDFs are correcting the asset-liability mismatch, and also help advance loans for fresh infrastructure projects. The urgent need to improve infrastructure prompted the Indian Planning Commission to estimate infrastructure spending in the 12th Five Year Plan (2012-17).

FlashNews:

“Entrepreneurial hunger, technology enablement to drive massive growth”

Tata Power Odisha Discoms Empower Women with ‘Nua Arambha’ Careers Initiative

Deepak Gupta Named CMD of GAIL, to Drive Energy Growth

India Is Advancing Growth While Preserving Heritage: Sonowal

ISA and IIT Delhi Partner to Build Global Solar Skills

Solar Service Searches Surge 43% Nationwide, Justdial Data Shows

Centre Clears ₹7.97 Billion Green Hydrogen Jetty at Paradip Port

ONGC Hosts 7th Para Games, Championing Inclusion in India Inc.

India’s Space Sector Secures Cyber Shield with CERT‑In, SIA‑India Guidelines

GAIL Breaks Ground on Sohna R&D Centre to Drive Clean Energy Innovation

Veolia Secures 2 Landmark Mumbai Water Projects to Boost Urban Sustainability

Emirates SkyCargo Expands India Freighter Network to Meet Rising Trade Demand

Colliers Maps 30 Industrial & Warehousing Growth Hubs Across India

PAIMANA Portal Tracks ₹39 Trillion Infrastructure Projects in January 2026

Tata Power-Warwick Alliance to Accelerate Energy Systems Innovation

India’s Space Kidz Launches World’s First Space Curriculum for Schools

Road Awards Slowdown to Hit Execution, Intensify Bidding: ICRA

Clean Energy Transition: India’s Global Leadership

Dual Airports to Handle 40 Million Passengers in 2026, Timely Ramp‑Up Crucial: Crisil Ratings

Tag: Infradebt

Infradebt refinances road project

India Infradebt (Infradebt), which is the countryÂ’s first Infrastructure debt funds (IDFs) in the NBFC format, completed its first transaction by refinancing a road project of Zirakpur-Parwanoo section of NH-22. The stretch is built by Himalayan Expressway, which is part of Jaiprakash Group. The debt fund is sponsored by ICICI Bank along with Bank of Baroda, Citigroup and LIC

India Infradebt to issue Rs 5 bn worth debentures

In order to finance infrastructure projects, India Infradebt is in the process of issuing Rs 500 crore worth of debenture. The debenture was assigned AAA/Stable rating by CRISIL. ICICI Bank, Bank of Baroda, Life Insurance Corporation of India and Citicorp Finance (India) jointly promoted Infradebt as an infrastructure debt fund (IDF) in the non-banking financial company