Domestic steel prices have witnessedan unprecedented rise from the second half of FY2021.The economic support measures unveiled by various countries will keep the demand for steel high. The near absence from the world export market and a higher import by China are among the major factors keeping steel prices at elevated levels. Continued higher demand from the Middle Kingdom on the back of the stimulus package and its target to bring down production levels in 2020 to reduce CO2 emissions will be important factors behind the strengthening of global steel prices. By RASHMI RAWAT

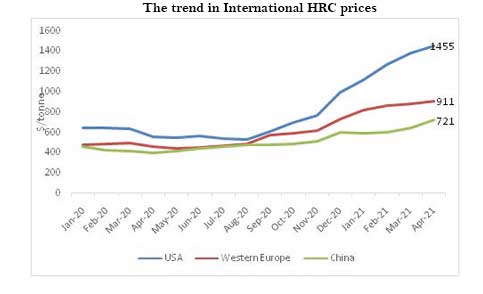

Domestic steelmakers hiked prices in line with higher international prices and high iron oreprices fuelled by a higher Chinese demand initially as the country beefed up spending on infrastructure to spur recovery amid the pandemic.With the opening of markets outside of China such as the US and Europe with the easing of lockdown-related restrictions and the stimulus packages announced by their respective governments, the steel demand began to outpace supply in those markets. Currently, hot-rolled coil (HRC)prices have risen 80-160 per cent across different markets.

Steel prices of HRC (FOB) in the US are up 160 per cent YoY at $1,455 per tonne in April 2021, surpassing the high of $1,100 per tonne in 2008, the year of the global financial crisis. HRC prices in Western Europe are up 96per centYoY at $911 per tonne in April 2021. In China, prices are around $721 per tonne, up 79per centsince a yearago. Comparatively, Indian HRC prices are around $821 per tonne, nearly 44per centlower than steel prices in the US. Steel players who idled their capacities in the early stages of the Covid-19 pandemic are unable to catchup with the revival in demand, which has led to a surge in steel prices in the US and Europe.

Chinese customs data also showed that the country imported a record 1.17 billion tonnes of iron ore in 2020 as compared to 1.07 billion tonnes in 2019. Import of steel in the US has also picked due to shortage in domestic supply. In February 2021, US imports were up 1.7 million tonnes from 1.37 million tonnes in February 2020.

Apart from the demand-supply imbalance, cost-push from high iron ore prices also kept steel prices elevated. While demand for iron ore remained strong,supplies of the commodity from Brazil – one of the world’s largest producers – were constrained due to severe weather conditions and Covid-19 induced restrictions,leading to a sharp spike in prices.This, in turn, led to a surge in steel prices. Iron ore prices have risen 80 per cent from April 2020 to an average of $169 per dry metric tonne unit (dmtu) in March 2021.

OVER-SUPPLY OF COKING COAL

While iron ore prices have risen to a nine-year high, coking coal prices have fallen to a four-year low due to restrictions imposed by China on coking coal imports from Australia and China’s preference to meet its demand from domestically produced coking coal. This has created an over-supply of Australian coking coal thereby keeping the prices in check. Hard coking coal prices have fallen steadily from $159 per tonne in March 2020 to $114 per tonne in March 2021. The ongoing trade tensions between Australia and China have led to the latter sourcing its imported coking coal requirements from North America, as a result of which prices of coking coal in North America have risen, while prices of Australian coking coal have softened. India mainly imports coking coal from Australia and lower coking coal prices have benefitted the Indian steel companies.

After a sharp drop in Q1FY21, the domestic steel industry’s operating margin rebounded in Q3 benefiting from improving domestic demand and realisations on the one hand and lower input costs on the other hand. As a result, the OPM curve once again crossed the RM cost curve and this trend is likely to prevail at least for the December 2020 and March 2021 quarter. Domestic steel spreads are at a multi-year high at around Rs 30,000-33,000 per tonne. Integrated steel producers who own captive iron ore mines are expected to enjoy higher spreads, while for the unintegrated steel producers any further hike in iron ore prices may hurt their margins.

PRICE OUTLOOK

An up-cycle in steel prices isexpected to continue in FY22. The firming ofglobal steelpricesand an uptick in domestic demand will keep steel prices at higher levels. The economic support measures unveiled by various countries will keep the demand for steel high. The near absence from the world export market and a higher import by China are among the major factors keeping steel prices at elevated levels. Continued higher demand from the Middle Kingdom on the back of the stimulus package and its target to bring down production levels in 2020 to reduce CO2 emissions will be important factors behind the strengthening of global steel prices. Demand-supply imbalance in the global market will also continue to present export opportunities to domestic players.

Going forward, we expect government-fuelled infrastructure spending to drive steel demand in India. The Union Budget for 2021-22 has a sharp 34.5 per cent YoY increase in allocation for Capex at Rs 5.54 trillion. The budget’s thrust is on infrastructure creation and manufacturing to propel the economy. Therefore, enhanced outlays for key sectors like defence services, railways, and roads, transport and highways would provide impetus to steel consumption, which is expected to grow by 10-12 per centin FY2022 to cross 100 million tonnes for the first time.

‘Cannot let our guard down yet’

TV Narendran, CEO & Managing Director, Tata Steel

The Covid-19 outbreak in early 2020 brought global economic activities to a near standstill. The Central Government’s early and sustained response to the pandemic including several socio-economic measures has been commendable.

Tata Steel managed to navigate this period with strong financial discipline, and cash flow management. Through the pandemic, our priorities remained focused on the health and safety of our workforce. We have been at the forefront of developing industry-specific protocols – from testing parameters to contact tracing, monitoring social distancing norms, classifying employee risk levels, and providing appropriate healthcare responses. More importantly, Tata Steel played a key role in Covid-19 relief initiatives within the communities around its areas of operation.

In 2021, we are optimistic about the demand for steel in India for several reasons. Firstly, we are seeing an inflow of funds from across sectors and an uptick in the overall consumption. Secondly, the government’s efforts of improving infrastructure, coupled with the Aatmanirbhar Bharat policy and the production-linked initiative (PLI), are bound to further boost the money inflow into the system. Further, government focus on rural infrastructure projects will also give an impetus to steel demand.

Given all of this, we believe that the steel demand in the country should grow at least at the rate of GDP growth or higher in FY2022. Typically, this is the trend in a developing country, though traditionally in India steel demand has been lower than the GDP growth rate.

Globally, steel prices are likely to stay firm as China is not expected to export large volumes owing to a better balance in their domestic market, and there are no other very significant exporters in the world market. We are optimistic about the overall demand for steel and hence the performance of the steel industry and Tata Steel.

As far as iron ore is concerned, we have seen a sharp rise in prices primarily because China has recovered quite well. The coal prices have softened because of the geopolitical issues between China and Australia. Consequently, more coal is available from Australia in the world market, and India being a big importer of coal, is witnessing softening of prices. Overall, the raw material is likely to be a mixed bag.

Currently, there is much-improved capacity utilisation by most of the steel producers in the country and they have healthy order books. However, most steel producers, including us, do prefer to sell more in the domestic market. Overall, the demand-supply situation favours the steel producers with strong international prices. We are certainly back to where we were before the pandemic and we expect the trend to continue through FY2022. The pandemic, however, is not behind us yet and we cannot let our guard down.

Tata Steel has always risen to the challenges of a highly cyclical industry and emerged stronger through downcycles. This bears testimony to its future-readiness.

‘Economic momentum powering demand revival’

Seshagiri Rao, Joint Managing Director JSW Steel & Group CFO

The global GDP in CY2021 is expected to increase by 4 per cent, supported by government policy measures and central banks. The expected recovery in 2021 will be influenced by the effective pace of vaccination. The US economy continued to show resilience during the pandemic, with the accommodative monetary policy and fiscal stimulus underpinning the growth outlook.

Fresh Covid-19 outbreaks across Europe and Japan may lead to slower than expected recovery. However, business sentiment in the EU in the manufacturing sector is relatively strong. The start of the vaccination campaigns should aid in improving trade and consumption, which bodes well for the economic growth outlook.

China’s 4Q CY2020 GDP growth of 6.5 per cent reflects a strong economic rebound. The outlook is positive for broad-based growth across investment, manufacturing and services. Re-emergence and mutations of the virus, and slower than expected pace of vaccination pose risks to the global growth outlook.

India’s PMI and IIP rebounded as 3Q2021 saw continued and broadening recovery with further easing of restrictions on mobility in India. Commencement of vaccination and declining cases are expected to sustain recovery. The trend of increasing monthly imports and higher labour-intensive exports like textiles, leather and gems signify economic recovery.

There has been strong growth in the automotive sector, notably in passenger vehicles and two-wheelers and tractors due to strong rural demand. The recovery in residential real estate and continued traction in commercial real estate is a bright spot, with scope for the structural revival of the sector.

The Central Government’s thrust on National Infrastructure Pipeline (NIP) comprising roads, urban housing, railways and power is likely to support recovery in the gross fixed capital formation (GFCF) cycle and India is well-placed to benefit from realignment of global supply chains and “China+1” approach of MNCs. The Production-Linked Incentive (PLI) scheme launched by the government to promote select 10 sectors, will help create champions in each sector to boost manufacturing.

The RBI stance is expected to be accommodative as CPI inflation declined sharply in December to a 14-month low of 4.6 per cent as food prices fell.

Indian steel demand has picked up well on the back of the strong economic momentum. Domestic steel mills have significantly reduced exports, to cater to this increased demand, and steel imports have increased sharply recently.

Leave a Reply

You must be logged in to post a comment.