With the right safeguards and incentives, India can lay the groundwork for a truly aatmanirbhar (self-reliant) infrastructure financing ecosystem—one where citizens don’t just contribute to the nation’s development but actively co-build and co-benefit from it, argues Shivam Bajaj.

Once marred by mounting non-performing assets, regulatory gridlock, and land acquisition hurdles, the Indian infrastructure industry was viewed with trepidation by investors. Projects routinely stalled, timelines stretched endlessly, and returns were unpredictable. The period 2010 to 2014 was particularly grim, characterised by stalled projects, delayed milestone payments, and ballooning project costs. Infrastructure companies struggled to survive, and waves of bad debts surged across the banking system.

During this phase, infrastructure development revolved largely around roads, highways, and coal-based thermal power plants. However, in both segments, fundamental issues derailed progress. In roads and highways, acquisition delays, sluggish clearances, and unmet traffic projections led to massive project stress. Several developers went bust or entered insolvency proceedings, with assets landing at the National Company Law Appellate Tribunal (NCLAT) for resolution. Meanwhile, in the power sector, developers heavily invested in coal-fired plants, only to face coal supply constraints that prevented many from reaching commercial operations.

The turning point

As these traditional models faltered,India began pivoting toward renewable energy, with significant capital inflows into solar and wind projects. Initially viewed with scepticism due to high capital intensity and uncertain returns, renewable energy gradually proved its commercial viability, marking a fundamental shift in India’s power strategy and climate commitments.

Responding to the broader crisis in the infrastructure sector, the government launched sweeping reforms. Among the most consequential was the implementation of the Insolvency and Bankruptcy Code (IBC), which transformed promoter behaviour and instilled financial discipline across the sector. The fear of losing control through insolvency proceedings served as a powerful deterrent against irresponsible financial management.

Another game-changer was the introduction of infrastructure investment trusts (InvITs). Designed to unlock developer capital, InvITs helped them deleverage balance sheets while offering institutional and retail investors a regulated, tax-efficient vehicle for infrastructure exposure. Over the years, InvITs have become a linchpin of the country’s infra-financing toolkit, increasingly attracting global institutional capital, including Canadian pension funds, sovereign wealth funds, and global infra-focused platforms.

Looking ahead, the next generation of InvITs is expected to have a stronger retail orientation, empowering citizens to own and earn from the infrastructure they use daily. Whether through toll roads or power lines, InvITs offer a route to financial democratisation, with returns often 200-300 basis points higher than traditional savings products. This shift not only deepens public participation but also unlocks large-scale domestic capital essential for India’s ambitious infrastructure buildout.

Enter financial innovation

India’s financial innovation extended further with the development of the Gujarat International Finance Tec-City (GIFT City), offering Indian firms a platform to tap global capital. By enabling foreign currency listings and creating an internationally competitive financial ecosystem, GIFT City is now a key gateway for infrastructure companies seeking long-term offshore funding.

At the heart of India’s current infrastructure strategy lies asset monetisation—a model designed to generate upfront capital by leasing out revenue-generating public assets to private players, without relinquishing ownership. This framework—championed through the National Monetisation Pipeline (NMP)—aims to recycle capital into new infrastructure while boosting private sector participation.

The response from global investors has been overwhelmingly positive. Supported by a stable regulatory regime, long-term policy visibility, and improving governance standards, the country is now seen as a reliable destination for ‘patient capital’. Recent marquee transactions across roads, transmission lines, airports, and warehousing reflect rising foreign interest and confidence in the Indian infra story.

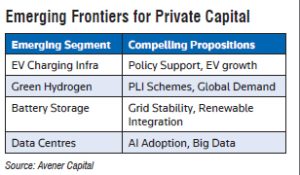

However, despite these advances, significant challenges persist. Land acquisition delays—especially in roads—and issues related to grid connectivity in the power sector remain formidable bottlenecks. For engineering, procurement and construction (EPC) players, the environment remains tough: stretched working capital cycles, compressed margins, and liquidity stress continue to hamper their sustainability. Additionally, policy clarity and long-term planning are still evolving in newer areas such as electric vehicle infrastructure, battery storage, and green hydrogen.

Democratising infrastructure

While large global institutional investors have anchored India’s infrastructure resurgence, the next phase of growth must involve a more inclusive capital base, most crucially, retail investors. InvITs represent a unique opportunity to transform infrastructure financing from a sophisticated investor-dominated activity into a grassroots movement. By offering Indian households regulated access to income-generating infrastructure assets, like toll roads, transmission lines, and renewable energy, InvITs can democratise asset ownership and make the infrastructure story more participatory.

Retail participation is not only a funding solution it is a strategic national priority. Currently, infrastructure capital in India flows disproportionately from foreign institutions, often at higher costs and with currency risks. For domestic EPC players and asset developers, this can inflate project costs and limit competitiveness. By allowing Indian citizens to co-own infrastructure assets, we keep domestic capital within our ecosystem and foster a cycle of local value creation.

Recent moves by the stock market

regulator Securities and Exchange Board of India (SEBI), such as its proposal to reclassify InvITs as equity instruments, are a step in the right direction. This reclassification will simplify the investment thesis for retail investors, potentially widen participation, and provide InvITs with a clearer identity in the capital markets. But to truly unlock the power of retail capital, India must also craft a robust infrastructure investment policy framework—one that builds investor trust, ensures regulatory clarity, enforces risk-mitigation mechanisms, and protects retail investors’ capital over the long term.

After all, these investors are already paying tolls, electricity bills, and gas charges—they are consumers of infrastructure. By enabling them to become co-owners, the country can generate a multiplier effect across the economy. If structured transparently and backed by strong governance, infrastructure investments can offer inflation-hedged, long-duration returns superior to traditional savings instruments.

A renewed policy push focused on

investor education, risk transparency, governance, and capital safety can make infrastructure investing mainstream. With the right safeguards and incentives, India can lay the foundation for an aatmanirbhar (self-reliant) infrastructure financing ecosystem—where ordinary citizens co-build and co-benefit from the nation’s development.

India’s infrastructure sector has come a long way from policy paralysis and financial distress to becoming a high-priority engine of growth. Key reforms such as the IBC, InvITs, asset monetisation, and capital market access via GIFT City have all reshaped the investment landscape, attracting both domestic and global long-term capital. The sector is no longer just about building roads and power plants; it is about creating a resilient, inclusive, and investor-friendly ecosystem that supports a trillion-dollar economy.

As India moves toward becoming the third-largest economy in the world, infrastructure will remain the bedrock of that journey. The vision ahead is clear: mobilise patient capital, democratise asset ownership, and drive inclusive growth. With continued reforms and policy stability, the Indian infrastructure sector is poised to not just build the nation but to build lasting wealth for its investors, both local and global.

About the author:

Shivam Bajaj, Founder & CEO, Avener Capital