So far, the Central Government has made all the right moves as it goes about setting up the National Bank for Financing Infrastructure and Development (NaBFID). But will the newly created entity be able to deliver on its mandate of developing a robust financing ecosystem for the infrastructure sector once it gets operationalised?

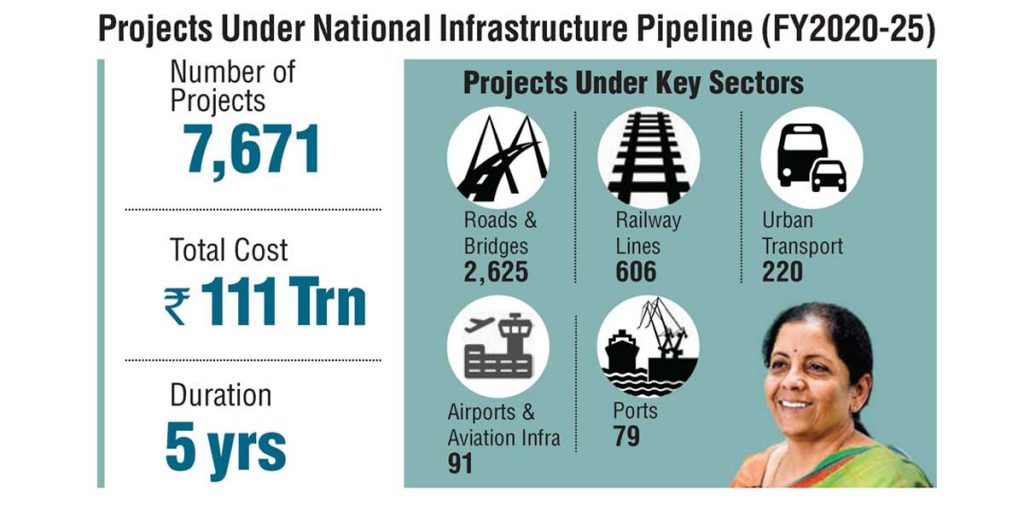

The Central Government has proposed to invest Rs 111 trillion in infrastructure projects under its very ambitious National Infrastructure Pipeline (NIP) initiative till FY2024-25. Soon after the 2019 announcement that intends to provide world-class infrastructure to citizens, a need was also felt to create an appropriate entity to fund such projects. For instance, the average implementation lifecycle of big-ticket infrastructure projects like high-speed railways, airports, ports, highways, river interlinking, etc., is four years. Simply put, it will require spending of 20 per cent of the project pipeline of say Rs 80 trillion to kickstart a series of such schemes.

And even if that kind of money is made available, another question arises? Where will that funding for the project pipeline be located and how will the allocation be monitored? After all, big-ticket infrastructure projects are conceptualised at multiple levels.

It is to this end that the National Bank for Financing Infrastructure and Development (NaBFID) has finally been created.

In her February Budget Speech in Parliament, where she first proposed the country’s newest and, effectively, the largest development financial institution (DFI), Finance Minister Nirmala Sitharaman had said, “Infrastructure needs long term debt financing. A professionally managed DFI is necessary to act as a provider, enabler and catalyst for infrastructure financing.”

Then in March, the NaBFID Bill received the presidential assent after being cleared by both houses of the Parliament. Due to become operational later this year, its formation was wholeheartedly welcomed by all stakeholders. One of its foremost advocates, Vinayak Chatterjee, Chairman, Feedback Infra Group & Chairman, Confederation of Indian Industry (CII), National Council on Infrastructure, told INFRASTRUCTURE TODAY, “By having a special set of dispensations under an Act of Parliament, with easy access to cheap funds, the NaBFID will be able to leverage itself better. Since the entity will be focused not on financial but on economic returns, it will be able to invest in large public work programmes or projects of national importance, where private capital won’t come.”

MAKING THE RIGHT MOVES

At a superficial glance, the government seems to have taken all the right steps during the NaBFID’s formation. Firstly, it has been ensured that there won’t be any day-to-day interference in its work to meet the development objectives of one of the world’s fastest-expanding major economies. It will also be peopled with top-quality personnel. In all probability, the NaBFID chairperson will an eminent professional and at least half of the board will consist of non-official directors. The Central Government will nominate two directors, up to three directors can be elected by shareholders and up to three independent directors can be appointed by the board.

The tenure of the chairperson and directors will be five years and they will be eligible for reappointment for another five. In the days to come, it is expected to function along the lines of the Reserve Bank of India (RBI) or Chief Election Commission (CEC), i.e., acting in the best interests of the country even while taking cognisance of any demands made by the Central Government.

Very importantly, the board, as well as employees of the NaBFID, will enjoy a great degree of protection from judicial actions as well as investigation and prosecutions from law enforcement agencies like the police, Central Bureau of Investigation (CBI), Serious Fraud Investigation Office (SFIO) and Enforcement Directorate (ED). This has been done to expedite decision-making and ensuring that outcomes do not result in harassment on trumped-up corruption charges of people associated with it.

However, as mentioned earlier, this is not the first time that such an entity has been created. In a newly Independent India short of capital, the now-defunct Planning Commission had debated on the areas where the meagre resources available could be allocated. Eventually, the nation’s first Prime Minister Jawaharlal Nehru and commission member Prasanta Chandra Mahalanobis identified sectors whose development needed to be prioritised.

Consequently, three prominent DFIs were formed. These were the Industrial Finance Corporation of India (IFCI) in 1948, Industrial Credit and Investment Corporation of India (ICICI) in 1955 and Industrial Development Bank of India (IDBI) in 1964. In hindsight, these DFIs, which subsequently transformed into commercial banks, played a very important role in fulfilling their mandate till the 1980s. Some of the leading industries that are around today would not have taken wings without the support extended by them.

But how is the new body going to be different from its predecessors like the Indian Infrastructure Finance Co. Ltd (IIFCL)? The simple answer to this question is in terms of size. In an exclusive interaction with the magazine,

Dr. TV Somanathan, Secretary Expenditure, Ministry of Finance, Government of India, explained, “Scale is one important dimension where it is going to be very different. Secondly, it is now part of a more integrated strategy as an institution that aspires to facilitate the creation of an infrastructure financing ecosystem in ways that the National Housing Bank (NHB) has done for the housing sector or National Bank for Agriculture and Rural Development (NABARD) has done for the agriculture sector.”

Also, since it is still early days, many have assumed that the NaBFID’s functioning would be akin to that of a wealth fund. However, that’s a misnomer. Its role would rather be of a new-age institution that is neither listed nor has shareholders who expect a return on investment. Once active, it would provide long-term financing taking a very long-term outlook.

Another important point that deserves mention is that given the exceptional work done by the government on boosting the country’s international outreach since 2014, NaBFID may even attract investment from other countries that are keen to be a part of the India growth story. Experts have said that if successful, the institution should be able to collect funds at the global interest rate of 2 per cent. Since lenders wouldn’t be seeking the return of that money anytime soon, the debt would be insulated from any deprecation in the value of the rupee.

FULL GOVERNMENT SUPPORT

The institution has a base capital of Rs 200 billion with a lending target of Rs 5 trillion for the next five years. This will help it raise Rs 3 trillion from the markets over the next few years to provide long-term financing for infrastructure projects. The Central Government will extend a grant of Rs 50 billion as tax-saving bonds to provide it with a hedge against any borrowings from multilateral or bilateral institutions to subsidise guarantee fees, thereby helping keep the cost of funds raised lower.

The government will also approach the regulators on hiking the cap for investment in the DFI by other entities like pension funds and insurance companies. A 10-year tax exemption will be provided to boost such investments. Although NaBFID is presently fully government-owned, the promoter (government’s) stake would be gradually be eased to 26 per cent over time.

With the NaBFID’s attention fixated on NIP,

Dr. Harish Sharma, Executive Director of the infrastructure and construction sector consultancy, Rudrabhishek Enterprises Ltd (REPL), pointed out, “The DFI will have its focus on the NIP, which itself is a unique initiative to provide world-class infrastructure to even the remotest parts of the country. The DFI will focus on mobilising the Rs 111 trillion required to complete the 7,000 infrastructure projects identified under the NIP.”

According to insiders like Dr. Sharma, besides having the government’s backing, the institution will have direct access to the funding facilities by the RBI. This will help it in generating funds at rates cheaper than those prevailing in the market. It will also be able to borrow money from the RBI with the help of instruments like bills of exchange, promissory notes, security of stocks, etc. This will ensure a perennial and economical source of funding to meet all of its requirements.

“India is striving to beat the economic slowdown by spending more and more on infrastructure. This also emphasises the need for a DFI. Under government backing, professional management, and well-defined targets, the DFI is expected to revolutionise long-term infrastructure financing in the country,” surmised Dr. Sharma.

CHALLENGES LIE ELSEWHERE

It is largely due to government support, aggregating low-cost funding won’t be a challenge before the NaBFID. However, as it goes about capitalising on the country’s infrastructure requirements, it will need to rise to some other tests in the offing.

“NaBFID is expected to face less challenge in mobilising low-cost resources upfront with appropriate government support, but it could encounter steep challenges in maintaining the cost advantage over a period of time, as the resources raised would have a fixed (specified) coupon with long maturity which may not be flexible. It would face competitive pressure in resource deployment as well as asset retention (refinancing by competitors),” Debashish Mallick, former Deputy Managing Director, EXIM Bank of India and Managing Director & CEO, IDBI Asset Management Co., noted in an article for the New Delhi-based think tank, Observer Research Foundation (ORF).

In Mallick’s view, the risk of an inflexible asset book would complicate matters. Since DFIs like NaBFID raise resources through financial instruments crafted to meet their specific needs, it made the exercise costlier and inflexible for them when compared to a bank, with its implication on relative product pricing and institutional asset and liability management (ALM) profile over time.

He, therefore, has recommended a three-pronged approach for the NaBFID to minimise such risks. Firstly, stipulating repricing options with suitable rate incentives after implementation to manage risks of refinancing once a project commences operations or attains stability. Secondly, raising resources with a weighted average maturity (WAM) to cover the implementation period of the portfolio loan assets, and not over the long-term, based on the ‘held to maturity’ concept to manage cost or maturity risks. And, thirdly, a security right over all present and future cash flows of the assisted company on a simultaneous basis along with other lenders and not be secured by the first charge over fixed assets only.

Going forward, the other danger that the NaBFID will need to guard against is being utilised as a tool to address the populist agenda of the government in power. Warned Chatterjee, “The political class must not impose on the institution include projects which are unviable or purely populist. Areas like education, healthcare, etc., should be prioritised, but the fear is that they often end up becoming hostage to politicians trying to win brownie points by pressurising the management to look at projects that need not be done at all in the first place.”

Ultimately, the NaBFID’s success would be assessed on three pillars: one, how much investment it has been able to attract, two, how well it can influence the government policy and, finally, the number of people it brings to the workforce by boosting infrastructure development.

–MANISH PANT

Leave a Reply

You must be logged in to post a comment.