Devraj Singh, Executive Director - Tax & Regulatory Services, EY India discusses various issues related to FDI in the Indian infrastructure sector. What has been the trend of FDI inflows into the Indian infrastructure sector in the last decade

FlashNews:

ISA and IIT Delhi Partner to Build Global Solar Skills

Solar Service Searches Surge 43% Nationwide, Justdial Data Shows

Centre Clears ₹7.97 Billion Green Hydrogen Jetty at Paradip Port

ONGC Hosts 7th Para Games, Championing Inclusion in India Inc.

India’s Space Sector Secures Cyber Shield with CERT‑In, SIA‑India Guidelines

GAIL Breaks Ground on Sohna R&D Centre to Drive Clean Energy Innovation

Veolia Secures 2 Landmark Mumbai Water Projects to Boost Urban Sustainability

Emirates SkyCargo Expands India Freighter Network to Meet Rising Trade Demand

Colliers Maps 30 Industrial & Warehousing Growth Hubs Across India

PAIMANA Portal Tracks ₹39 Trillion Infrastructure Projects in January 2026

Tata Power-Warwick Alliance to Accelerate Energy Systems Innovation

India’s Space Kidz Launches World’s First Space Curriculum for Schools

Road Awards Slowdown to Hit Execution, Intensify Bidding: ICRA

Clean Energy Transition: India’s Global Leadership

Dual Airports to Handle 40 Million Passengers in 2026, Timely Ramp‑Up Crucial: Crisil Ratings

Kazipet Coach Factory Ready for Commissioning as RVNL Completes Core Works

Suzlon Reshapes Leadership: J P Chalasani Elevated, Ajay Kapur Named Group CEO

Noida International Airport Partners Mann Fleet for Seamless Ground Mobility

SDHI to Complete Five Offshore Support Vessels for San Maritime at Pipavav Shipyard

Tag: IDFs

Governments do not have magic wands for economic revival

The Government is taking all the necessary steps to revive the economy. It has taken quick decisions and is also focusing on executive and administrative capability to implement them.

IDFs are the best route to refinance existing projects

Sadashiv Rao, Chief Risk Officer, IDFC Ltd tells Rahul Kamat that IDF-NBFC is a safer route compared to IDF-Mutual Fund, as in the latter, the fund manager can invest in any project (under construction) which will have risk involved in it, and investors may not like to invest in high-risk projects.

Matching the mismatch

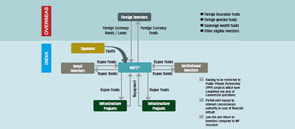

IDFs play a vital role as investment vehicles that can be sponsored by NBFCs and commercial banks in India. Shrikanth S writes on how IDFs are correcting the asset-liability mismatch, and also help advance loans for fresh infrastructure projects. The urgent need to improve infrastructure prompted the Indian Planning Commission to estimate infrastructure spending in the 12th Five Year Plan (2012-17).

Taking stock: Domino effect – Too late to stop?

Is the worst over for infrastructure? The fact that this question lingers is perhaps testimony to the uncertainty that prevails. Unrealistic bids, bureaucratic slowdown, social groundswell, coal scam, mining scam ... the list of factors that has created seemingly unstoppable negativity seems daunting. The government mainly the Prime Minister´s Office had to repeatedly intervene to address frustratingly sticky problems confronting the infrastructure sector.

Recovery or Illusion?

Industry observers have promptly branded the growth in some of the core sectors in the second quarter as ´encouraging´ and ´first signs of recovery´ for the infrastructure sectors.

Infradebt refinances road project

India Infradebt (Infradebt), which is the countryÂ’s first Infrastructure debt funds (IDFs) in the NBFC format, completed its first transaction by refinancing a road project of Zirakpur-Parwanoo section of NH-22. The stretch is built by Himalayan Expressway, which is part of Jaiprakash Group. The debt fund is sponsored by ICICI Bank along with Bank of Baroda, Citigroup and LIC

PM asks SEBI to support fund flow to infrastructure

Securities and Exchange Board of India (SEBI) received a request from Prime Minister Manmohan Singh to promote infra debt funds (IDFs) in order to boost funding to the infrastructure sector.

IDFs set to get funds from EPFO

Following the approval of new norms by the board of the Employees' Provident Fund Organisation, the pension fund may invest part of its Rs 5 trillion corpus in infrastructure debt funds (IDFs). The new norms allow the pension fund body to invest in bonds with tenures up to 25 years and this may enable it to consider IDF

Project finance: Time for calculating the risks

Employing probabilistic risk models could provide an objective basis of evaluating and tracking risks as they wax and wane through the project stages. Infrastructure projects are all about taking calculated risks, but before taking the risks, one needs to calculate them well,

- 1

- 2