On the occasion of International Women’s Day, Dr. P R Jaishankar, MD, IIFCL, launched the IIFCL’s Gender Equality and Social Inclusion (GESI) Cell, to promote gender equality and social inclusion in its infrastructure financing approach. The GESI Cell will focus on gender tagging, capacity building, policy development, and enhancing gender-focused impact assessments. It will help...

FlashNews:

ISA and IIT Delhi Partner to Build Global Solar Skills

Solar Service Searches Surge 43% Nationwide, Justdial Data Shows

Centre Clears ₹7.97 Billion Green Hydrogen Jetty at Paradip Port

ONGC Hosts 7th Para Games, Championing Inclusion in India Inc.

India’s Space Sector Secures Cyber Shield with CERT‑In, SIA‑India Guidelines

GAIL Breaks Ground on Sohna R&D Centre to Drive Clean Energy Innovation

Veolia Secures 2 Landmark Mumbai Water Projects to Boost Urban Sustainability

Emirates SkyCargo Expands India Freighter Network to Meet Rising Trade Demand

Colliers Maps 30 Industrial & Warehousing Growth Hubs Across India

PAIMANA Portal Tracks ₹39 Trillion Infrastructure Projects in January 2026

Tata Power-Warwick Alliance to Accelerate Energy Systems Innovation

India’s Space Kidz Launches World’s First Space Curriculum for Schools

Road Awards Slowdown to Hit Execution, Intensify Bidding: ICRA

Clean Energy Transition: India’s Global Leadership

Dual Airports to Handle 40 Million Passengers in 2026, Timely Ramp‑Up Crucial: Crisil Ratings

Kazipet Coach Factory Ready for Commissioning as RVNL Completes Core Works

Suzlon Reshapes Leadership: J P Chalasani Elevated, Ajay Kapur Named Group CEO

Noida International Airport Partners Mann Fleet for Seamless Ground Mobility

SDHI to Complete Five Offshore Support Vessels for San Maritime at Pipavav Shipyard

Tag: IIFCL

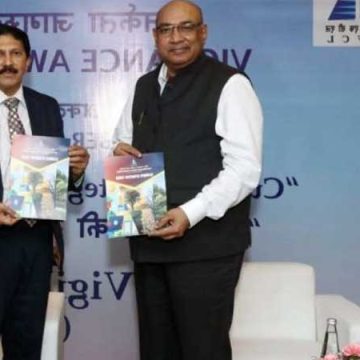

IIFCL Launches Strategic Document to Support Green Infra

In a significant step towards promoting sustainable infrastructure, the government-owned financial institution IIFCL unveiled its Climate Strategy 2030 document during the Vigilance Meet held on October 30 in New Delhi. The document was released in the presence of Dr. PR Jaishankar, Managing Director, IIFCL, with AS Rajeev, Vigilance Commissioner, Central Vigilance Commission, as the Chief...

$30 trillion economy seems possible

Unveiling a $30T Economic Vision Government funding has to be complemented by private sector investment. By 2018 to 2020, assets which were created in the early phase were completed and started earning revenue to become an asset class of its own. So that has again evinced interest of investors, says Padmanabhan Raja Jaishankar, Managing Director, India...

Indian Infrastructure: Attracting World Interest

Indian Infrastructure: Global Magnet Funds, policies, technologies and a winning attitude, this defines the Indian infrastructure financing sector today. The first assets created under this National Infrastructure Pipeline are now generating revenue, thus whipping up more investor interest. The bonds market has seen significant reforms. The government remains the largest driver, but the private sector...

IIFCL raises Rs 1,500 crore through bonds/debentures

The funds thus raised would provide impetus to various ambitious plans of the Government of India towards development of infrastructure sector in India. New Delhi, March 12, 2024 IIFCL received overwhelming response to its fund raising programme through bonds/debentures with subscription of Rs 3,494.50 crore which is nearly 7x of the base issue size of...

Today the road sector is much more mature and robust

A candid interview with experienced financier PR Jaishankar, MD, IIFCL PR Jaishankar, MD, India Infrastructure Finance Company Ltd. (IIFCL), an experienced financier helming the infrastructure financing affairs, shares his deep thoughts on the latest progress, the pace of road development, new strategies carried out by IIFCL to speed up the infra projects, and much more from...

NaBFID Financing for the Future

So far, the Central Government has made all the right moves as it goes about setting up the National Bank for Financing Infrastructure and Development (NaBFID). But will the newly created entity be able to deliver on its mandate of developing a robust financing ecosystem for the infrastructure sector once it gets operationalised? The Central...

DFI to create financing ecosystem for infra projects

The new Development Finance Institution (DFI) will be a fairly large entity that will play a key role in the Central Government’s strategy to facilitate the creation of a robust financing ecosystem for infrastructure projects in the country. Simultaneously, the government also remains committed to rolling out systemic interventions to ensure the necessary action on...

We need global capital for India’s infrastructure projects

Until recently, we used to talk about the cost of funds being too high and, as you are aware, some infrastructure projects have a long gestation period. There is a period of construction and then there are cost overruns and delays.

MEP Infra receives date for Talaja-Mahuva Hybrid Annuity project

MEP Infrastructure Developers Limited has been given April 25, 2017, as the Appointed Date for its Hybrid Annuity project in Gujarat (the Talaja-Mahuva section) in accordance with the Concession Agreement executed with the National Highways Authority of India (NHAI). The project is a part of the Bhavnagar-Veraval stretch.