On the occasion of International Women’s Day, Dr. P R Jaishankar, MD, IIFCL, launched the IIFCL’s Gender Equality and Social Inclusion (GESI) Cell, to promote gender equality and social inclusion in its infrastructure financing approach. The GESI Cell will focus on gender tagging, capacity building, policy development, and enhancing gender-focused impact assessments. It will help...

FlashNews:

DIAL Launches Family@DEL: First Family‑Centric Travel Initiative at an Indian Airport

India’s SDHI Lands Landmark Oman Defence Ship Deal

Air India Unveils First Line‑Fit Boeing 787‑9, Signals Bold Global Transformation in 2026

Vizhinjam Expansion Strengthens India’s Maritime Competitiveness: Sonowal

Tata Power Odisha Discoms Secure Top National Rankings for Third Consecutive Year

SDHI Secures $227 Million Chemical Tanker Deal, Revives India’s Commercial Shipbuilding

India’s Energy Transition Sets Global Pace: Pralhad Joshi at Davos

IWDC Clears ₹15 Billion Projects to Boost Green Mobility, Cargo and River Tourism

World Bank Approves $815 Million Financing for Tata Power-DGPC Dorjilung Hydropower Project in Bhutan

Indian Railways Deploys Humanoid Robot ASC ARJUN at Visakhapatnam for Smart Station Security

India’s Power Grid Crosses 500,000 Circuit Km, Marks 71.6% Growth Since 2014

India Inc Optimistic on Growth, Flags Infrastructure, Defence and Export Priorities: FICCI Survey

NHAI, Konkan Railway Ink MoU to Boost Integrated Road‑Rail Infrastructure Development

DGCA Digitises Pilot Licensing with Electronic ATPL Services to Strengthen Aviation Ecosystem

Power Minister Calls for Financially Strong Discoms to Drive India’s Energy Future

BLR Airport Launches Gate Z, India’s First Social Lounge Redefining the Airport Experience

MoPNG Highlights Financing Strength, Regulatory Reforms Ahead of New Upstream Bid Rounds

ABB India Modernises BPCL’s Vadinar‑Bina Pipeline for Uninterrupted Operations

Vaishnaw Projects 6-8% Growth, Highlights Reform Momentum at Davos

Tag: IIFCL

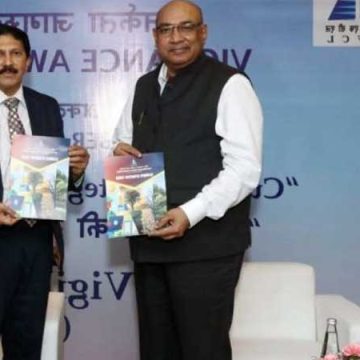

IIFCL Launches Strategic Document to Support Green Infra

In a significant step towards promoting sustainable infrastructure, the government-owned financial institution IIFCL unveiled its Climate Strategy 2030 document during the Vigilance Meet held on October 30 in New Delhi. The document was released in the presence of Dr. PR Jaishankar, Managing Director, IIFCL, with AS Rajeev, Vigilance Commissioner, Central Vigilance Commission, as the Chief...

$30 trillion economy seems possible

Unveiling a $30T Economic Vision Government funding has to be complemented by private sector investment. By 2018 to 2020, assets which were created in the early phase were completed and started earning revenue to become an asset class of its own. So that has again evinced interest of investors, says Padmanabhan Raja Jaishankar, Managing Director, India...

Indian Infrastructure: Attracting World Interest

Indian Infrastructure: Global Magnet Funds, policies, technologies and a winning attitude, this defines the Indian infrastructure financing sector today. The first assets created under this National Infrastructure Pipeline are now generating revenue, thus whipping up more investor interest. The bonds market has seen significant reforms. The government remains the largest driver, but the private sector...

IIFCL raises Rs 1,500 crore through bonds/debentures

The funds thus raised would provide impetus to various ambitious plans of the Government of India towards development of infrastructure sector in India. New Delhi, March 12, 2024 IIFCL received overwhelming response to its fund raising programme through bonds/debentures with subscription of Rs 3,494.50 crore which is nearly 7x of the base issue size of...

Today the road sector is much more mature and robust

A candid interview with experienced financier PR Jaishankar, MD, IIFCL PR Jaishankar, MD, India Infrastructure Finance Company Ltd. (IIFCL), an experienced financier helming the infrastructure financing affairs, shares his deep thoughts on the latest progress, the pace of road development, new strategies carried out by IIFCL to speed up the infra projects, and much more from...

NaBFID Financing for the Future

So far, the Central Government has made all the right moves as it goes about setting up the National Bank for Financing Infrastructure and Development (NaBFID). But will the newly created entity be able to deliver on its mandate of developing a robust financing ecosystem for the infrastructure sector once it gets operationalised? The Central...

DFI to create financing ecosystem for infra projects

The new Development Finance Institution (DFI) will be a fairly large entity that will play a key role in the Central Government’s strategy to facilitate the creation of a robust financing ecosystem for infrastructure projects in the country. Simultaneously, the government also remains committed to rolling out systemic interventions to ensure the necessary action on...

We need global capital for India’s infrastructure projects

Until recently, we used to talk about the cost of funds being too high and, as you are aware, some infrastructure projects have a long gestation period. There is a period of construction and then there are cost overruns and delays.

MEP Infra receives date for Talaja-Mahuva Hybrid Annuity project

MEP Infrastructure Developers Limited has been given April 25, 2017, as the Appointed Date for its Hybrid Annuity project in Gujarat (the Talaja-Mahuva section) in accordance with the Concession Agreement executed with the National Highways Authority of India (NHAI). The project is a part of the Bhavnagar-Veraval stretch.