With this, REC becomes the first public sector NBFC in India to be certified under ISO 31000, marking a new milestone in institutional risk governance. Government-owned non-banking financial company REC Ltd has received ISO 31000:2018 certification for its enterprise-wide risk management framework. The achievement makes REC—a Maharatna PSU—the first Indian public sector NBFC to attain...

FlashNews:

India’s SDHI Lands Landmark Oman Defence Ship Deal

Air India Unveils First Line‑Fit Boeing 787‑9, Signals Bold Global Transformation in 2026

Vizhinjam Expansion Strengthens India’s Maritime Competitiveness: Sonowal

Tata Power Odisha Discoms Secure Top National Rankings for Third Consecutive Year

SDHI Secures $227 Million Chemical Tanker Deal, Revives India’s Commercial Shipbuilding

India’s Energy Transition Sets Global Pace: Pralhad Joshi at Davos

IWDC Clears ₹15 Billion Projects to Boost Green Mobility, Cargo and River Tourism

World Bank Approves $815 Million Financing for Tata Power-DGPC Dorjilung Hydropower Project in Bhutan

Indian Railways Deploys Humanoid Robot ASC ARJUN at Visakhapatnam for Smart Station Security

India’s Power Grid Crosses 500,000 Circuit Km, Marks 71.6% Growth Since 2014

India Inc Optimistic on Growth, Flags Infrastructure, Defence and Export Priorities: FICCI Survey

NHAI, Konkan Railway Ink MoU to Boost Integrated Road‑Rail Infrastructure Development

DGCA Digitises Pilot Licensing with Electronic ATPL Services to Strengthen Aviation Ecosystem

Power Minister Calls for Financially Strong Discoms to Drive India’s Energy Future

BLR Airport Launches Gate Z, India’s First Social Lounge Redefining the Airport Experience

MoPNG Highlights Financing Strength, Regulatory Reforms Ahead of New Upstream Bid Rounds

ABB India Modernises BPCL’s Vadinar‑Bina Pipeline for Uninterrupted Operations

Vaishnaw Projects 6-8% Growth, Highlights Reform Momentum at Davos

Aerem Solutions Secures $15 Million to Drive Distributed Solar Adoption Across India

Tag: NBFCs

Embrace emerging financing architecture: IIFCL MD

As the relay financing framework slowly takes hold in infrastructure financing, the government-owned Indian Infrastructure Finance Co. Ltd (IIFCL) is busy prepping to support megaprojects, Dr. Padmanabhan Raja Jaishankar, MD tells Manish Pant. Alternate Investment Financing (AIF) to source funds from international investors is already being rolled out. Jaishankar is also optimistic that given the significant stress...

DFI to deliver long term-economic returns

As a development finance institution (DFI), the National Bank for Financing Infrastructure and Development (NaBFID), will facilitate cheap capital for public works programmes and projects, says Vinayak Chatterjee, Chairman, Feedback Infra Group & Chairman, Confederation of Indian Industry (CII), National Council on Infrastructure. Like the DFIs created by policymakers in the 1950s for making industrial capital accessible,...

Mission Solar

India´s approach of focussing largely on utility-scale solar parks and aggressive pricing has attracted a lot of scepticism. The renewable energy sector has shown tremendous growth over the last two years.

¨Raising large-scale infra funds is a difficult task¨

While the government and the RBI have eased norms and pushed for financing opportunities, actual benefits will take time to trickle down, says Vishwas Udgirkar, Senior Director, Deloitte India.

IDFs are the best route to refinance existing projects

Sadashiv Rao, Chief Risk Officer, IDFC Ltd tells Rahul Kamat that IDF-NBFC is a safer route compared to IDF-Mutual Fund, as in the latter, the fund manager can invest in any project (under construction) which will have risk involved in it, and investors may not like to invest in high-risk projects.

Matching the mismatch

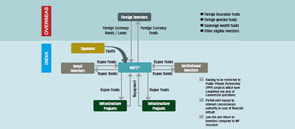

IDFs play a vital role as investment vehicles that can be sponsored by NBFCs and commercial banks in India. Shrikanth S writes on how IDFs are correcting the asset-liability mismatch, and also help advance loans for fresh infrastructure projects. The urgent need to improve infrastructure prompted the Indian Planning Commission to estimate infrastructure spending in the 12th Five Year Plan (2012-17).

Banks Wary of Lending to NBFC Sector

In the 12 months to June 2013, growth of bank lending to non-banking finance companies (NBFCs) declined to 1.9 per cent compared to 44 per cent in the year-ago period. Banks are said to be wary of lending to NBFCs following stricter guidelines issued by Reserve Bank of India (RBI).

PE funds raise capital to finance business

Data from media reports indicate that 12 private equity funds are raising at least $6.6 billion for investment in Asia. Reports indicate that a substantial part of this amount would be invested in Indian businesses. The financing by private equity investors would meet the funding requ

RBI permits ECB facility for NBFC-AFCs

Reserve Bank of India (RBI) allowed Non-banking finance companies (NBFCs) categorised as Asset Finance Companies (AFCs) to avail of external commercial borrowing (ECB). But the central bank imposed certain conditions for such NBFCs to access ECB window. One of the condition is that they would avail ECB under the automatic route with minimum average maturity of five years. Further, the funds raised through the ECB route must