An estimated 30 people will leave rural India for urban areas every minute during the next 20 years. At this rate, in the next two decades, most Indian cities are likely to double their size in terms of population and more than double in area.

FlashNews:

India Is Advancing Growth While Preserving Heritage: Sonowal

ISA and IIT Delhi Partner to Build Global Solar Skills

Solar Service Searches Surge 43% Nationwide, Justdial Data Shows

Centre Clears ₹7.97 Billion Green Hydrogen Jetty at Paradip Port

ONGC Hosts 7th Para Games, Championing Inclusion in India Inc.

India’s Space Sector Secures Cyber Shield with CERT‑In, SIA‑India Guidelines

GAIL Breaks Ground on Sohna R&D Centre to Drive Clean Energy Innovation

Veolia Secures 2 Landmark Mumbai Water Projects to Boost Urban Sustainability

Emirates SkyCargo Expands India Freighter Network to Meet Rising Trade Demand

Colliers Maps 30 Industrial & Warehousing Growth Hubs Across India

PAIMANA Portal Tracks ₹39 Trillion Infrastructure Projects in January 2026

Tata Power-Warwick Alliance to Accelerate Energy Systems Innovation

India’s Space Kidz Launches World’s First Space Curriculum for Schools

Road Awards Slowdown to Hit Execution, Intensify Bidding: ICRA

Clean Energy Transition: India’s Global Leadership

Dual Airports to Handle 40 Million Passengers in 2026, Timely Ramp‑Up Crucial: Crisil Ratings

Kazipet Coach Factory Ready for Commissioning as RVNL Completes Core Works

Suzlon Reshapes Leadership: J P Chalasani Elevated, Ajay Kapur Named Group CEO

Noida International Airport Partners Mann Fleet for Seamless Ground Mobility

Tag: Srei

UP tops infra projects under PPP mode

Uttar Pradesh (UP) has clocked the highest share in infrastructure projects carried out under the public private partnership (PPP) mode across India.

Maharashtra leads in termination of PPPs

Maharashtra leads the list of states where the most number of public-private partnership (PPP) investment projects have been terminated.

t of SEZs. As I mentioned earlier

Taking a cue from China´s success in SEZs, the government brought in the policy framework for Indian Special Economic Zones. The SEZs were established with the intention of bringing export-oriented growth to the country

Global pension funds have both liquidity and appetite for long-term investments

In a freewheeling conversation, Moses Harding, Group CEO and Chief Economist, Srei Infrastructure Finance Limited, says that he is bullish over the prospects of the infrastructure finance sector.

Matching the mismatch

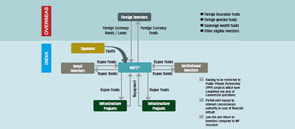

IDFs play a vital role as investment vehicles that can be sponsored by NBFCs and commercial banks in India. Shrikanth S writes on how IDFs are correcting the asset-liability mismatch, and also help advance loans for fresh infrastructure projects. The urgent need to improve infrastructure prompted the Indian Planning Commission to estimate infrastructure spending in the 12th Five Year Plan (2012-17).

Still a distant dream?

The establishment of the road regulator, as was announced in the 2013-14 Union Budget, might take place only after the elections. While many industry players want a regulator to be set up, what will the entity finally look like? Rahul Kamat takes a peek at the current trends.

Pooling cash flow

The concept of pooled financing comes at a time when the industry needs it more than ever in recent history.Clearing nearly Rs 2 lakh crore (still a small fraction of the pending part of the pie) was the first step for the Cabinet Committee for Investments and the special committee set up by the Prime Minister's Office for this express purpose.

Collateral Damage

The Supreme Court’s recent verdict to strike down 122 telecom licences in the much-debated 2G case resembles like an earthquake whose aftershocks are felt well outside the epicentre: Heads will roll but as a oblique, rather than direct, consequence of the shake-up.