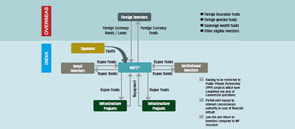

IDFs play a vital role as investment vehicles that can be sponsored by NBFCs and commercial banks in India. Shrikanth S writes on how IDFs are correcting the asset-liability mismatch, and also help advance loans for fresh infrastructure projects. The urgent need to improve infrastructure prompted the Indian Planning Commission to estimate infrastructure spending in the 12th Five Year Plan (2012-17).

FlashNews:

“Entrepreneurial hunger, technology enablement to drive massive growth”

Tata Power Odisha Discoms Empower Women with ‘Nua Arambha’ Careers Initiative

Deepak Gupta Named CMD of GAIL, to Drive Energy Growth

India Is Advancing Growth While Preserving Heritage: Sonowal

ISA and IIT Delhi Partner to Build Global Solar Skills

Solar Service Searches Surge 43% Nationwide, Justdial Data Shows

Centre Clears ₹7.97 Billion Green Hydrogen Jetty at Paradip Port

ONGC Hosts 7th Para Games, Championing Inclusion in India Inc.

India’s Space Sector Secures Cyber Shield with CERT‑In, SIA‑India Guidelines

GAIL Breaks Ground on Sohna R&D Centre to Drive Clean Energy Innovation

Veolia Secures 2 Landmark Mumbai Water Projects to Boost Urban Sustainability

Emirates SkyCargo Expands India Freighter Network to Meet Rising Trade Demand

Colliers Maps 30 Industrial & Warehousing Growth Hubs Across India

PAIMANA Portal Tracks ₹39 Trillion Infrastructure Projects in January 2026

Tata Power-Warwick Alliance to Accelerate Energy Systems Innovation

India’s Space Kidz Launches World’s First Space Curriculum for Schools

Road Awards Slowdown to Hit Execution, Intensify Bidding: ICRA

Clean Energy Transition: India’s Global Leadership

Dual Airports to Handle 40 Million Passengers in 2026, Timely Ramp‑Up Crucial: Crisil Ratings

Finally the Cure?

Long term financing has been ailing the infrastructure sector making alternate non-banking financing options like Infrastructure Debt Funds (IDFs) more viable. Rahul Kamat and Garima Pant explore the IDF environment in India. The yawning infrastructure gap in the country is seeking closure to unleash its locked growth potential.

Seeking Revival

The 6th Annual India Roads Conference organised by ASAPP Media invited industry think tanks and sector people to deliberate, discuss and ponder over the issues plaguing the roads sector in the country. The conference focused on 'Accelerating India's Road to Growth'.

Borrowing of infra firms rises faster than revenue

Official data shows that the borrowing of 17 construction and infrastructure (C&I) companies that are part of the BSE-500 index has risen more than their revenue and net profit during the last five years since 2008. While borrowings of these firms rose a little over five times, to Rs 2.7 lakh crore since 2008, their revenue and cas

Rupee weakness to have minimal impact on Hindalco

Kumar Mangalam Birla, Chairman of Hindalco Industries said the impact of rupee depreciation on the company's balance sheet would be minimal as it does not have much of foreign currency loan. Addressing shareholders at the companyÂ’s 54th annual general meeting, Birla said the firm has a foreign loan of only $100 million and so the impact of rupee deva

PFC to issue tax free bonds

State-run Power Finance Corp is in the process of issuing around Rs 150 crore ($23 million) worth of tax-free bonds across different maturities. While the firm would issue 10-year tax-free bonds at 8.04 percent, 15-year bonds at 8.41 percent, and 20-year bonds at 8.40

RBI working paper moots new banking structure

The Reserve Bank of India (RBI) released a discussion paper on the proposed structure of banking system in India. The paper calls for abandoning the present two-tier banking structure in favour of a four-tier banking structure, which would usher in more competition, and resilience in the

RCap expects to reduce debt if given bank license

The debt-to-equity ratio of Reliance Capital would decline to 0.5 from 1.7 if the company manages to get banking license from Reserve Bank of India (RBI). It may be recalled that the central bank invited application for new bank licenses from corporates, non banking finance companies and other entities earlier. Follo

SBH chief rules out merger with SBI at present

M Bhagavantha Rao, Managing Director of State Bank of Hyderabad (SBH) ruled out the possibility of merger of the bank with State Bank of India (SBI) at the moment considering the bifurcation of Andhra Pradesh. It may be recalled that a separate state of Telangana has been carved out from Andhra Pradesh recently and the ensuing political situation is not cond

Banks may lend Rs 60 bn more to Essar Steel

In order to prevent Essar Steel from approaching

the corporate debt restructuring (CDR) cell, lenders to the company provided an further loan of Rs 6,000 crore. The company borrowed this amount at an interest rate of 12.50 percent. The Ruia-group firm would use around Rs 2,000-2,500 crore of the Rs 6,000 crore to repay group com