If the change in governance at the Centre last year brought reason to cheer, the first year of the NDA government´s rule also showed that intent alone was never going to be enough. A number of missions launched, projects cleared and policies on the anvil, the work is only just beginning.

Modi 2.0 is the evolution of a promise. That it will take more than right intent to deliver on that promise was evident throughout the just-ended monsoon session in Parliament. Reforms to the Land Act, the cornerstone of Prime Minister Narendra Modi´s pro-growth agenda, was set aside as the opposition parties sought to appear farmer-friendly and vehemently denied the passage of the bill.

Obviously, the promise that a Narendra Modi-led government holds for the economic growth of the country will take more than just a year or two to fructify. Not that anyone is expecting anything sooner. After all, Rome wasn´t built in a day. World class infrastructure, efficiency in governance, smart cities, etc., things that other nations have already successfully tackled, took years to materialise in those countries. For instance, in France, one of the most developed countries in Europe, planning and implementation was spread out over many decades. ¨In France, the state is the main body and we have planned plenty of things during the sixties, seventies and even till the end of the nineties. However, over there, we have one state. Here in India, you have 29 states and seven union territories, all with their own rules. This makes it more challenging,¨ says Yves Perrin, the country´s Consul General to India in Mumbai.

No wonder then, from the very outset, Modi has emphasised the importance of closer cooperation between the central and state governments to effectively achieve common objectives.

In specific areas such as infrastructure and project finance, there has been a slow revival in fortunes since Modi took office. Positive policy and regulatory interventions such as deferment of premium, e-auctions of coal blocks, online clearances, allowing banks to invest in infrastructure bonds, etc., are slowly but steadily reviving confidence amongst stakeholders. Copious amounts have been announced to aid languishing activity in road construction and the pace has picked up from 2 km constructed per day when the government took over to 14 km a day by March 2015. Projects worth more than $57 billion which were stuck have been looked at out of which 44 projects worth $12 billion have been terminated while 144 projects have been cleared.

Union Minister for Road Transport and Highways Nitin Gadkari has repeatedly said that by December 2015, not a single project will remain stuck.

According to investment research firm India Ratings & Research, the huge capital requirement in infrastructure, combined with a freeze on lending by banks and slowing private equity deals could help link long-term, fixed-interest rate debt and infrastructure assets. While reasonable investment appetite exists for investments in revenue-based assets, the firm says in a research note that ¨stable revenue performance and the comfortable quality of the revenue counter-party will mainly drive the ratings for these market instruments. Performance guarantees from reasonably rated sponsors could help strengthen the operating profile of the project.¨

A pick-up in the GDP, reining in inflation and more rate cuts that are widely expected can only have beneficial effects on cash flows and improving liquidity in general. Already in 2015, India has become the fastest-growing among the big economies in the world. India´s growth also compares favourably with its emerging markets peers such as Brazil, Russia, South Africa and others.

To be sure, falling oil prices have helped, taming inflation and with respect to current account and fiscal deficits. The government has been lucky with oil prices falling about 60 per cent between May 2014 and January 2015. However, if the stock markets are any reflection, there isn´t much to be optimistic about. The Sensex is down over six per cent year-to-date. Profits of Sensex-listed companies in the April-June quarter were up only a per cent versus a 24 per cent gain in the year-ago period.

Indian exports fell eight straight months through July. In the current financial year, too, goods exports are down 15 per cent versus the year-ago period.

The real growth in earnings is awaited while the government puts in place policies and regulatory frameworks with an eye towards the future. In its favour is a young and aspiring workforce, increasingly desirous of efficient governance, living in smart cities, in Swachh Bharat, being digitally connected and making it in India. Set for reform, progress, growth and development, the ´Modi Sarkar´ has its work cut out. It has to succeed. The stakes are too high to even contemplate the thought of failure. Maybe finally, India has a government that understands the significance of the slogans it creates. For now, we´re willing to concede Varsh Ek Kaam Anek at the end of the first year to the Modi government.

We´ll wait and watch if Modi Sarkaar Kaam Lagataar will finally add up to a prematurely coined slogan about a decade ago called India Shining.

Increasing expenditure

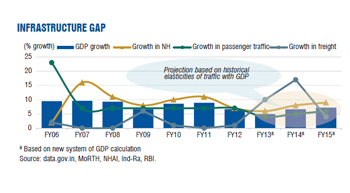

- The total infrastructure spending by the Planning Commission is estimated at about 10 per cent of GDP during the 12th Five Year Plan (2012-2017), up from 7.6 per cent in the previous plan (2007-2012).

- India´s investment in infrastructure is likely to double to around $1trillion during the 12th plan.

- The proportion of planned expenditure has increased at a CAGR of 13 per cent for the FY11-FY16 period.

- Out of the total infrastructure spending, the allocation to roads sector substantially increased to 25 per cent in FY16 from 13-16 per cent between FY11-FY15.

- The importance of this sector is evident from the fact there has been a staggering 125 per cent increase in allocation to roads and highways by the government.

Leave a Reply

You must be logged in to post a comment.