IDFs play a vital role as investment vehicles that can be sponsored by NBFCs and commercial banks in India. Shrikanth S writes on how IDFs are correcting the asset-liability mismatch, and also help advance loans for fresh infrastructure projects.

The urgent need to improve infrastructure prompted the Indian Planning Commission to estimate infrastructure spending in the 12th Five Year Plan (2012-17) at $1 trillion as against $500 billion in the 11th Five Year Plan. It is expected that the private sector will contribute 50 per cent of the investment, of which the debt component is projected to be $350 billion. Traditionally, the Indian banks were primary source of debt funding for the infrastructure projects. Funding infra projects widened the asset-liability profile of the banks, given the long gestation period of 10 to 15 years for the infra projects and one to two years tenure of most bank deposits. This mismatch was further exacerbated by concentration of risk for the banks (infrastructure accounted for over 11 per cent of their overall portfolio) as they were reaching the maximum limits for lending to infrastructure projects. Given the magnitude of infrastructure investment during the 12th Five Year Plan, and also the constraints faced by the bank, the government conceived IDF as an alternative for attracting investors with long term horizon such as pension funds, sovereign wealth funds, insurance companies, etc for providing long term funding to the infrastructure sector.

Playing vital role

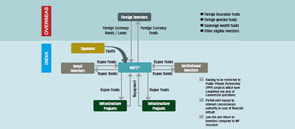

In this setting, IDFs play a vital role as investment vehicles that can be sponsored (with equity participation in the range of 31-49 per cent) by Non-Banking Financial Companies (NBFCs) and commercial banks in India. In this institutional investors, both domestic and offshore such as insurance and pension funds can invest by purchasing units and bonds issued by the IDFs. With the money raised, IDFs refinance the existing debt of infrastructure companies that have successfully completed the first year of commercial production. Thus, with the repayment, the overall tenure of loans lent out by banks reduces, correcting the asset-liability mismatch, and also helps them advance loans for fresh infrastructure projects. This take-over of loans from banks is covered by a tripartite agreement between the concessionaire (the group that is developing the infrastructure), IDF, and the project authority (statutory body set up to develop infrastructure) to ensure an obligatory buyout with termination payment in case of default in repayment by the concessionaire. Due to the perceived low level of risk, the credit rating is high.

As of December 2013, Ministry of Finance and Department of Economic Affairs has announced two IDF-NBFCs (Infradebt, L&T) and four IDF-MFs (IIFCL, IL&FS, SREI and IDFC) have been registered by the end of September 2013 and four IDF-MFs are on the verge of commencing. Since the Finance Minister's announcement on creation of IDF (in February 2011) this has not seen a great deal of success due to some inherent issues such as:

List of 16 projects submitted to the cabinet where construction has started:

| Project name | Developer | Length (km) | Project cost (`mn) | Premium (mn) |

|---|---|---|---|---|

| Belgaum-Dharwad | Ashoka Buildcon | 80 | 4,800 | 310 |

| Dankuni-Kharagpur | Ashoka Buildcon | 111 | 13,960 | 1,261 |

| Sambalpur-Baragarh | Ashoka Buildcon | 88 | 1,350 | 13 |

| Odisha border-Aurang Saraipalli | BSCPL | 150 | 12,320 | 297 |

| Indore-Dewas | DLF Gayatri | 45 | 4,510 | 241 |

| Ludhiana-Talwandi | Essel Infra | 78 | 4,790 | 10 |

| Walajahpet-Poonamalli | Essel Infra | 93 | 12,880 | 1,620 |

| Gwalior-Shivpuri | Essel Infra | 120 | 10,550 | 660 |

| Deoli-Kota | GVK Transportation | 124 | 8,500 | 486 |

| Vadodara-Surat | HCC | 7 | 4,732 | 2,220c |

| Jetpur-Somnath | IDFC Plus | 127 | 8,300 | 227 |

| Tumkur-Chitradurga | IRB Infrastructure | 114 | 8,390 | 1,404 |

| Ahmedabad-Vadodara | IRB Infrastructure | 205 | 30,000 | 3,089 |

| Nagpur-Wainganga Bridge | JMC | 60 | 4,840 | 274 |

| Aurangabad-Barwa Adda | KMC Construction | 222 | 23,400 | 1,350 |

| Beawer-Pali-Pindwara | L&T IDPL | 246 | 24,000 | 2,510 |

| Rohtak-Jind | NKJ | 53 | 2,833 | 10 |

| Etawah-Chakeri | Oriental Structural Engineers | 157 | 14,915 | 920 |

| Hosur-Krishnagiri | Reliance Infrastructure | 65 | 9,250 | 669 |

| Gomati ka-Chauraha-Udaipur | Sadbhav Engineering | 83 | 12,800 | 216 |

| Solapur-Bijapur | Sadbhav Engineering | 111 | 9,500 | 756 |

| Panvel-Indapur | Supreme | 84 | 9,400 | 340 |

| Total (16 projects) | 2,423 | 236,020 | 18,883 |

Source: JM Financial

Note: The chances of refinancing are higher under IDF because these are under construction projects

Debt provided by IDF-NBFCs is senior to the existing project debt issued by the bank. This is a major impediment in the success of IDFs.

- Fundamental mismatch between banks and investors – Investors of IDFs want to invest in assets that are generating cash and banks are keen to hive off the assets which are facing time and cost over-runs. After the commencement of commercial operation, the project starts earning free cash flows and hence has reduced credit risk. Banks might be reluctant to sell the profitable assets in lieu of a new project.

- Given the scale of investment, with a few bad projects the losses might be substantial, resulting in huge losses to the funds and this gets distributed to the fund investors. In the mutual fund structure, lack of credit enhancement is a drawback. In the NBFC mode, equity sponsorship serves the function of credit enhancement; hence it will result in preventing losses for fund investors.

- Large number of infrastructure projects in India was stalled due to issues in regulatory clearances, environmental issues and land acquisition. Furthermore, absence of skilled project managers is one of the major causes for time and cost overruns. Primarily due to project scope creeps, and inadequate detailed project reports, the project witness time overruns resulting in material price escalations.

In the developed countries, capital markets are the primary means of infrastructure financing. Prior to financial crisis, the governments of developed countries (example Japan and the US) were the largest source of infrastructure funding. Given the developed countries government's unsustainable sovereign debt levels, the infrastructure funding programme is likely to depend more on pension funds, sovereign wealth funds, and insurance companies.

India's supply of transport, Information & Communication Technologies (ICT), and energy infrastructure remains largely insufficient and ill-adapted to the needs of the economy, despite the steady improvement that has been made since 2006. The Indian business community repeatedly cites infrastructure as the single biggest hindrance for doing business, ahead of corruption and cumbersome bureaucracy”-World Economic Forum's Global Competitiveness Report.

Leave a Reply

You must be logged in to post a comment.