Devraj Singh, Executive Director - Tax & Regulatory Services, EY India discusses various issues related to FDI in the Indian infrastructure sector. What has been the trend of FDI inflows into the Indian infrastructure sector in the last decade

FlashNews:

RAHSTA will drive road construction innovation: Sundaresan

Trimble MD champions digital solutions for industry growth at RAHSTA

Vipin Sondhi: Indian infra booms with road construction opportunities

RK Pandey promotes safe road development at RAHSTA launch

RAHSTA to pave the way for innovation in road construction: AK Singh, NHAI

Road construction leaders launch RAHSTA Expo 2024 in Delhi

Road construction industry launches RAHSTA Expo 2024 in Delhi

Road construction industry to launch RAHSTA Expo 2024

Shapoorji Pallonji divests Gopalpur port for Rs 33.5 bn

15th Cement EXPO to be held in March 2025 in Hyderabad

Debt Financing: Funding Sustainable Infra

$30 trillion economy seems possible

Indian Infrastructure: Attracting World Interest

IIFCL raises Rs 1,500 crore through bonds/debentures

Metro Rail sustainability suffering from affordability & connectivity

Dr E Sreedharan, India’s ‘Metro Man’ & India’s Top Metro Rail CEOs converge in Mumbai for CW Metro Rail Conference

Road Contracts awarded drop to less than half!

Synergy Steels clinches Award for Best Environment & Pollution Control Practices, 2023

Will QCBS phase out L1 for Infrastructure Procurement?

Tag: IDFs

Governments do not have magic wands for economic revival

The Government is taking all the necessary steps to revive the economy. It has taken quick decisions and is also focusing on executive and administrative capability to implement them.

Matching the mismatch

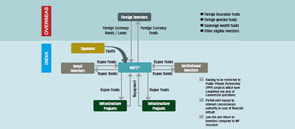

IDFs play a vital role as investment vehicles that can be sponsored by NBFCs and commercial banks in India. Shrikanth S writes on how IDFs are correcting the asset-liability mismatch, and also help advance loans for fresh infrastructure projects. The urgent need to improve infrastructure prompted the Indian Planning Commission to estimate infrastructure spending in the 12th Five Year Plan (2012-17).

IDFs are the best route to refinance existing projects

Sadashiv Rao, Chief Risk Officer, IDFC Ltd tells Rahul Kamat that IDF-NBFC is a safer route compared to IDF-Mutual Fund, as in the latter, the fund manager can invest in any project (under construction) which will have risk involved in it, and investors may not like to invest in high-risk projects.

Taking stock: Domino effect – Too late to stop?

Is the worst over for infrastructure? The fact that this question lingers is perhaps testimony to the uncertainty that prevails. Unrealistic bids, bureaucratic slowdown, social groundswell, coal scam, mining scam ... the list of factors that has created seemingly unstoppable negativity seems daunting. The government mainly the Prime Minister´s Office had to repeatedly intervene to address frustratingly sticky problems confronting the infrastructure sector.

Recovery or Illusion?

Industry observers have promptly branded the growth in some of the core sectors in the second quarter as ´encouraging´ and ´first signs of recovery´ for the infrastructure sectors.

Infradebt refinances road project

India Infradebt (Infradebt), which is the countryÂ’s first Infrastructure debt funds (IDFs) in the NBFC format, completed its first transaction by refinancing a road project of Zirakpur-Parwanoo section of NH-22. The stretch is built by Himalayan Expressway, which is part of Jaiprakash Group. The debt fund is sponsored by ICICI Bank along with Bank of Baroda, Citigroup and LIC

PM asks SEBI to support fund flow to infrastructure

Securities and Exchange Board of India (SEBI) received a request from Prime Minister Manmohan Singh to promote infra debt funds (IDFs) in order to boost funding to the infrastructure sector.

IDFs set to get funds from EPFO

Following the approval of new norms by the board of the Employees' Provident Fund Organisation, the pension fund may invest part of its Rs 5 trillion corpus in infrastructure debt funds (IDFs). The new norms allow the pension fund body to invest in bonds with tenures up to 25 years and this may enable it to consider IDF

Project finance: Time for calculating the risks

Employing probabilistic risk models could provide an objective basis of evaluating and tracking risks as they wax and wane through the project stages. Infrastructure projects are all about taking calculated risks, but before taking the risks, one needs to calculate them well,

- 1

- 2