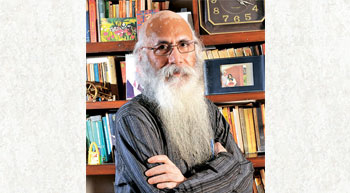

Prof Arun Kumar, senior economist and former Sukhamoy Chakravarty Chair Professor in the Centre for Economic Studies and Planning, Jawaharlal Nehru University, believes the GST regime needs to be rolled out gradually to prevent it from getting entangled in any complications.

What is your macroeconomic perspective on the proposed GST regime?

The macroeconomic aspects of GST haven´t been taken into account. If the government says that it will collect more revenue, then that means that prices will have to rise because it´s an indirect tax. If prices rise, then industrial output would tend to stagnate or decline. Then the argument that GST will lead to 1- 2 per cent increase in GDP growth does not stand. The government says the states will be compensated for loss in revenue. Now suppose you don´t go for a revenue-neutral rate (RNR) because that will imply that you will be collecting the same amount of revenue as today, the Centre and states should get the same amount of revenue. If the states get less revenue and the Centre has to compensate for the same, fiscal deficit will rise because if the Centre will be getting less, the states are also getting less. But the government has been saying that the fiscal deficit will not be allowed to rise. This means that if the fiscal deficit has to be retained at today´s levels, then some other expenditure cuts will have to take place in the budget. These usually happen in the social sector expenditure, whether it´s on education, health or infrastructure. Second, what the GST is doing is that it is brining many of the indirect taxes on one platform. Now that is supposed to ease the business climate in the country. But who trades globally in India? It´s the large companies. So while the large-scale industry will get benefited as the cost of production for it declines, the small scale industry won´t as it buys and sells locally and will lose out to competition. Moreover, with 94 per cent of the employment in the unorganised sector, if unemployment takes place, demand will go down. If that happens, then GDP growth will also decline.

Now the next point is fiscal federalism. Fiscal federalism means we are a union of diverse states where Assam´s requirement may not be the same as Gujarat´s and Jammu & Kashmir´s not the same as that of Tamil Nadu. How will the requirements that are supposed to be different for different states be fulfilled, if there is one uniform tax across the country? The second point about fiscal federalism is that we are not only a union of states, but there are three tiers: Centre, states and local bodies. The Centre and states are making an arrangement about how they will get their taxes. But the local bodies also have important levies like entertainment tax and octroi, and they are being merged. So how will the local bodies earn their revenue? Even if you go for an across-the-board RNR, then taxes on basic commodities will go up and those on final goods will come down. If that happens, prices of basic goods will tend to rise more than that of final goods. And that will be inflationary, because that will get passed down all the way. If you have the price of coal rising, all other prices will increase even if you have RNR. Therefore, you will have to keep lower rates for basic commodities.

Then they are talking about a very high rate of tax of 15-18 per cent according to the Arvind Subramanian Committee. And before that, NIPFP is talking about 23-27 per cent. These are very high rates, because on services you have a 12 per cent tax rate. Now that going to 15-18 per cent or to 23-27 per cent will make prices of all services rise. That will be highly inflationary unless the government compensates for that by lowering other tax rates. The services sector now constitutes 60 per cent of GDP. Now the trick the government adopts is that services are not part of the Wholesale Price Index (WPI). Even if prices of services go up, WPI doesn´t change. In the Consumer Price Index (CPI) too, only 18 per cent is made of services, with goods and agricultural products constituting the reminder. So inflation is taking place, but it is not being measured. And that can create complications for the entire thing.

Then, the GST is a much more complicated tax than any other tax we have had till now because ad valorem tax means that you only have to pay tax on receipt. But now you have to give it on receipt minus the input cost. So you need both the revenue as well as inputs. And that requires computerisation. We have already done that under VAT with sales tax, excise duty and service tax. But now sales tax is sought to be removed from sales tax into services, services into sales, services into excise and excise into services. But that also means lot of complications. For instance, if as a manufacturing firm I am buying paper, pencil, legal services and transportation, taxes on all those will have to be incorporated. Unless there is complete computerisation, this setoff will not come. That is what is going to create difficulties. That´s why my argument has been to expand slowly.

How can India Inc take advantage of the proposed tax regime?

See, the advantage would be that you would hopefully have less of paperwork, although lot of computerisation needs to be implemented. The complication may come that you have to register in 31 states. And then there are three taxes: Central Goods and Services Tax (CGST), State Goods and Services Tax (SGST) and Integrated Goods and Services Tax (IGST). So 31 x 3 has become 93. This registration may create some kind of problems. Then the small and medium scale sectors complain that large scale companies do not pay them on time by using them as a source of credit. If that continues to happen, the small scale sector will be in even more trouble. I have been asking my friends in the industry for the last one year, and they are not able to tell me the difficulties that they are likely to face. They are so underprepared! The idea that 17 taxes will come down to three is also not correct. If I am manufacturing cement, I don´t have to pay entertainment tax. So why should I worry about that? Then there are other levies. If the government wanted to remove levies it could done so independent of GST. Therefore, India Inc will have to brace itself for GST by keeping detailed accounting. Lot of things that were previously happening in cash, will be completely out of the net. So it will have to go in for very complex systems to be able to take advantage of GST. As GST has led to difficulties wherever it has been introduced, it´s better to be fully than partially prepared.

What does the GST regime portend for the infrastructure sector?

If we think about the infrastructure sector, it has two components. One, infrastructure has to be created. Two, once it is ready, it has to provide a service. You first put up a power plant and then supply electricity. Production of the infrastructure and then the services that are provided by it, both will come under GST. Now if it´s inflationary, the cost of infrastructure will go up. As it is, the infrastructure sector is already in deep trouble due to over-borrowing. If the costs rise further, then you will have a problem in setting up more infrastructure. In a poor country like India, you cannot sustain high-cost infrastructure without subsidy. You may set up a toll road, but many people try to avoid paying toll. That´s why the profitability of infrastructure in India cannot be like what it is in the West. Secondly, at the time of supplying infrastructure, you have to pay service tax etc., and those taxes will go up. So the cost of infrastructure will also go up. The infrastructure sector, therefore, may be hit both ways. Then electricity, petroleum and real estate are outside the GST net. But these items remain heavily taxed; then your costs will not fall. So one of the advantages that was supposed to be there that you get a set-off for the cost that you have incurred in paying for it in earlier stages, that will not be available to the infrastructure sector. Therefore, the industry must intercede with the Finance Ministry to try and sort out its problems both when it is producing infrastructure and supplying services.

So what would be the most appropriate way forward?

The most appropriate way forward would be to check the black economy, collect more direct taxes, and lower indirect taxes. That is the best way to move forward. If the GST is properly implemented, computerisation happens and black income generation is lowered, then direct tax collections will rise. That can be used to cut down the GST. So I would say, go for a lower than RNR rate and maybe take a hit on revenue to begin with. Secondly, when the GST was introduced, at the same time the Direct Taxes Code (DTC) was also introduced. But we have done nothing on the DTC front. At 5.5 per cent India is one of the lowest as far as direct tax: GDP ratio is concerned. It is lower than even most countries in the developing world.

If as per my estimate the size of the black economy is 62 %per cent of GDP and you manage to collect direct and indirect taxes at 40 per cent rate on this, you will get an extra 24 per cent tax to GDP ratio. This will help you in cutting down your indirect taxes to bare bones. The real crux of the problem for taxation in India and for a lot of the industry is the size of the black economy and the lack of direct tax collection.

Is that why a section of the infrastructure sector is so very apprehensive about the new tax regime?

They should be even more apprehensive! I think it has not sunk in into the industry what it will mean for it. Even a 12 per cent RNR rate may work. This tax is going to be levied on goods & services, minus agriculture. Say agriculture is 14 per cent of GDP. Now on 86 per cent of the GDP, you will have to collect 10.5 per cent, which is today collected in direct taxes. So RNR means that you should continue to collect 10.5 per cent of GDP on that. Now Customs duties are not part of the GDP, so 2.5 per cent of the GDP, which is collected as Customs duty, goes out. Now out of that 86 per cent, you have to leave out the unorganised sector. So say another 30 per cent gone. So from 86 per cent it becomes 56 per cent, on which you have to collect this 8 per cent. But you have make a further cut as bulk of your tax is coming from petroleum and sin goods like tobacco and liquor. Leave out another 2.5 per cent. So 8.5 per cent becomes 8 per cent. You have to collect 6 per cent out of 50 per cent. Therefore, it comes to roughly about 10 per cent to 12 per cent. Now I have estimated the size of the black economy to be 60 per cent of the GDP. Assume that you can bring 50 per cent of that into the tax net. That will raise 50 per cent back to 80 per cent. So with 80 per cent you have to collect only 5.5 per cent. If, as the government says, it will be able to check the black economy, in this case you require only 7 per cent rate of tax. But suppose the black economy doesn´t account for much. Even then it´s 10 per cent to 12 per cent. Depending on that, you can argue that the RNR rate instead of being 15 per cent to 18 per cent should be around 10 per cent to 12 per cent. And, therefore, the lower and higher level of taxation should be around that, rather than 15-18 per cent. That way the rates will come down and if that´s the way the infrastructure industry argues with the government, that will be good. If the black economy is checked, you will collect a lot more in direct taxes. Therefore, indirect taxes can come down. So industry and infrastructure should give this argument that instead of going with 15-18 per cent, go for 10-12 per cent to begin with.

The Centre has assured state governments that they would be compensated for any loss in revenue on account of the new tax regime for the next five years. Are there any similar implications for the infrastructure sector that need to be factored in? Post GST, is Viability Gap Funding (VGF) going be indispensable for infrastructure development in India?

That is not linked to GST. VGF is about the government´s view on how infrastructure should be provided. As I said, in a poor country like India, the paying capacity is low. For example, consider the heavily overloaded trucks on highways. That is because people are trying to make a profit out of whatever resource they have. The consumer wants to pay less and the fellow giving the service wants to charge less because otherwise he won´t get business. In advanced countries, if there are limits, you can only carry goods of up to a certain height or certain weight. So infrastructure of a certain quality at a certain price is accepted there, but it is not accepted here. Therefore, there will be a viability gap and that´s a separate issue than GST. But tax collection helps to fill up that viability gap. If you are able to check the black economy, then you can do VGF. In a country where 70 per cent of the population is really poor- even if you are a little bit above the poverty line doesn´t mean that you are middle class or rich – you have to make provision for very cheap infrastructure.

So you were asking, just like the states will be compensated by the Centre, will the Centre compensate the infrastructure centre for any losses?

The centre will be in a position to do that only if it collects more revenue from direct taxes. If it tries to collect more revenues from indirect taxes, that will be inflationary and will complicate matters. Its attempt should be to lower indirect taxes and raise more indirect taxes. But that is contingent on checking the black economy.

– MANISH PANT

Leave a Reply

You must be logged in to post a comment.